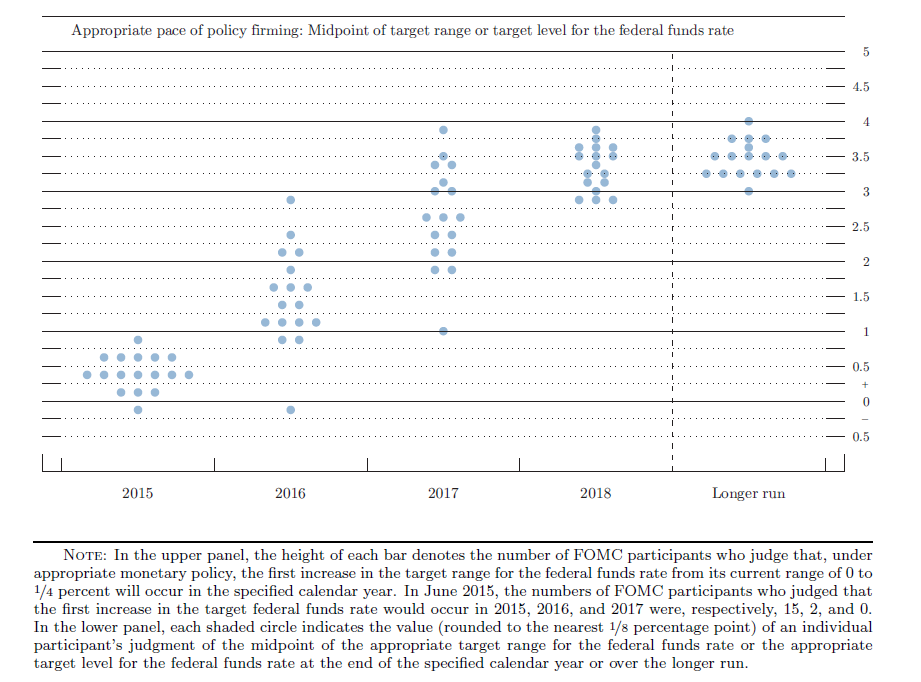

The crowd is buzzing over the possibility that the Federal Reserve may be considering negative interest rates. Where did that notion come from? Well, from the horse’s mouth. As noted earlier, an unnamed FOMC member recommended—for the first time in Fed history in terms of a formal, public document—that the central bank’s policy rate be set slightly below zero for this year and in 2016, as per two dots in yesterday’s dot plot (see chart below). It’s an idea that seems to be catching on… again. The Bank of England’s Andy Haldane just outlined the case for going negative in the UK.

As for the Fed’s tentative foray into the concept of negativity, some wonder if yesterday’s below-zero advice constitutes some sort of monetary joke. Or is it an early clue that lays the groundwork for QE4 and yet another embrace of monetary stimulus that goes above and beyond the usual fare? Not so fast, said Fed Chair Janet Yellen, who was quick to dismiss the idea in yesterday’s press conference. When asked about the subject, she quickly sacked the issue: “Let me be clear that negative interest rates was not something that we considered very seriously at all today,” she insisted. “It was not one of our main policy options” under consideration. Ok, but is it under consideration going forward?

In any case, the rumor mill has been set in motion and the machinery of inquiry and analysis has been let loose on this formerly esoteric subject in the annals of US central banking. Is it ready for prime time? Maybe not, but to be fair it was the Fed that let this gnarly monetary cat out of the bag.

Meantime, there’s a bull market in freshly minted theories about what the two subzero dots mean… or don’t. To get up to speed, here’s your short list of background intelligence for considering the prospect of going negative (maybe) with US monetary policy.

Current News/Analysis on the Negative Rate Dots

● Should interest rates go negative in the US? | CNN Money

● Janet Yellen Knocks Down Negative Interest Rate Idea | Dow Jones

● Fed Opens Pandora’s Box: What Happens Next | Zero Hedge

● One Monetary Policymaker Wants Negative Rates in the US | Bloomberg

General Research/Commentary On Negative Rates

● How Will Negative Rates Change the Rules of the Game? | CFA Institute

● How Low Can You Go? Negative Rates and The Flight to Safety | St Louis Fed

● If Interest Rates Go Negative… | NY Fed

● Ultra-low or negative rates: what they mean for financial stability and growth | BIS

Recent News Stories On Negative Rates

● Why use negative interest rates? | BBC

● Making the case for negative interest rates | Fortune

● Less Than Zero: When Interest Rates Go Negative | Bloomberg

● Negative interest rates: Coming to America? | Yahoo Finance

● Why negative rates are here—and won’t save the global economy | Economist

● Draghi (ECB) breaks new ground with negative interest rate | CNBC

● Sweden slashes interest rates further into negative territory | Telegraph

● Negative rates put world on course for biggest default in history | Telegraph

● Swiss National Bank to Adopt a Negative Interest Rate | NY Times

● Bank of Israel’s Sussman Says Interest Rate Can Go Negative | Bloomberg