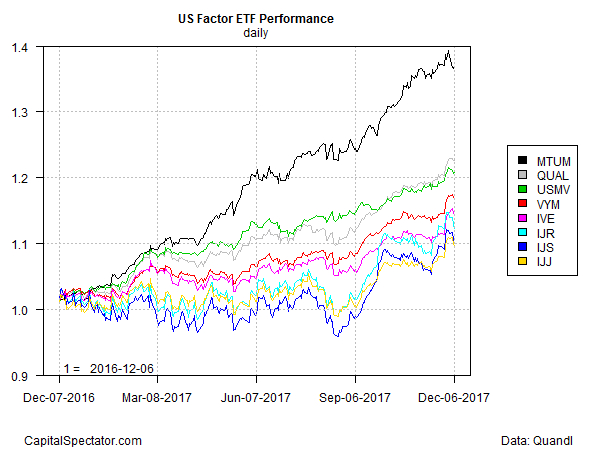

No one will confuse it with Bitcoin, but momentum is certainly red hot among US equity factor strategies, based on a set of ETFs. Stocks exhibiting relatively strong and persistent performance have outperformed for much of the year so far and the gap has widened in recent weeks.

All the major equity factor strategies are posting solid gains for the one-year trend through yesterday’s close (Dec. 6), which makes momentum’s run all the more impressive. Indeed, the strategy’s return edge over the rest of the field has continued to accelerate since our update a month ago.

The iShares Edge MSCI USA Momentum Factor ETF (MTUM) is ahead by 36.9% over the past 12 months through Wednesday. That’s a hefty spread over the other factor ETFs, which are currently posting one-year gains ranging from the second-place 22.6% for iShares Edge MSCI USA Quality Factor ETF (QUAL) down to a relatively weak 9.5% for iShares S&P Mid-Cap 400 Value ETF (IJJ). The stock market overall, represented by the S&P 500-tracking SPDR S&P 500 (SPY), is ahead by 21.4% on a total-return basis — a strong gain but far beyond MTUM’s one-year surge.

Reviewing a performance chart for the factor ETFs for the past year shows that momentum’s supremacy (via MTUM) has been nothing short of remarkable.

How long can momentum’s dominance last? Unclear. Eventually, the tide will turn, of course. Meantime, recent data from Bloomberg may cheer contrarians looking for a sign that regime shift is near. On Monday, the company advised that “the Bloomberg US pure momentum portfolio had its worst week since April 2016 [through Friday, Dec. 1]. Such a uniform demolition of long-short momentum can be caused by a concentrated bet unwinding, according to Pravit Chintawongvanich, the head of derivatives strategy at Macro Risk Advisors.”

For additional research on the factor ETFs cited above, here are links to the summary pages at Morningstar.com:

iShares Edge MSCI Min Vol USA (USMV) – low-volatility

Vanguard High Dividend Yield ETF (VYM) – high-dividend yields

iShares Edge MSCI USA Quality Factor (QUAL) – so-called quality stocks

iShares Edge MSCI USA Momentum Factor (MTUM) – price momentum

iShares S&P Small-Cap 600 Value (IJS) – small-cap value stocks

iShares S&P Mid-Cap 400 Value (IJJ) – mid-cap value stocks

iShares S&P 500 Value (IVE) – large-cap value stocks

iShares Core S&P Small-Cap – small-cap core

Pingback: Momentum Leaves Other Factor Strategies In The Dust This Year - TradingGods.net

Pingback: A Week In Review: Sector Analysis, Correlations, A Unique Price Movement, Money Mistakes, IPO Activity, & Wagyu Beef -