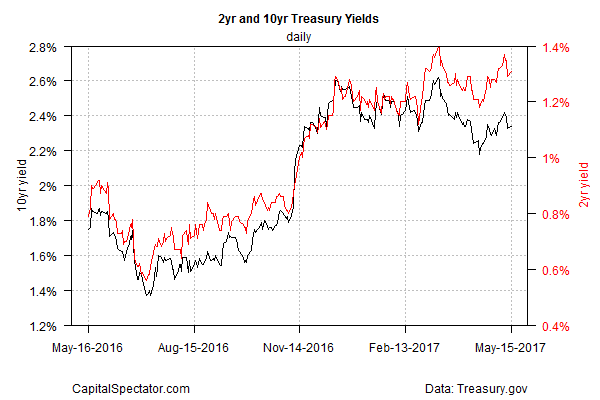

Judging by futures prices, the market’s expecting that the Federal Reserve will raise interest rates again at next month’s monetary policy meeting. That’s also the implied outlook in the 2-year yield (considered to be the most-sensitive spot on the yield curve for rate expectations), which is close to a post-recession high. But the Treasury market’s softer inflation forecasts still leave room for debate about what comes next.

Fed funds futures are currently pricing in a roughly 79% probability that the Fed will lift its target rate at the June 14 FOMC meeting, based on CME data in early trading for May 16. The relatively elevated 2-year yield supports the forecast.

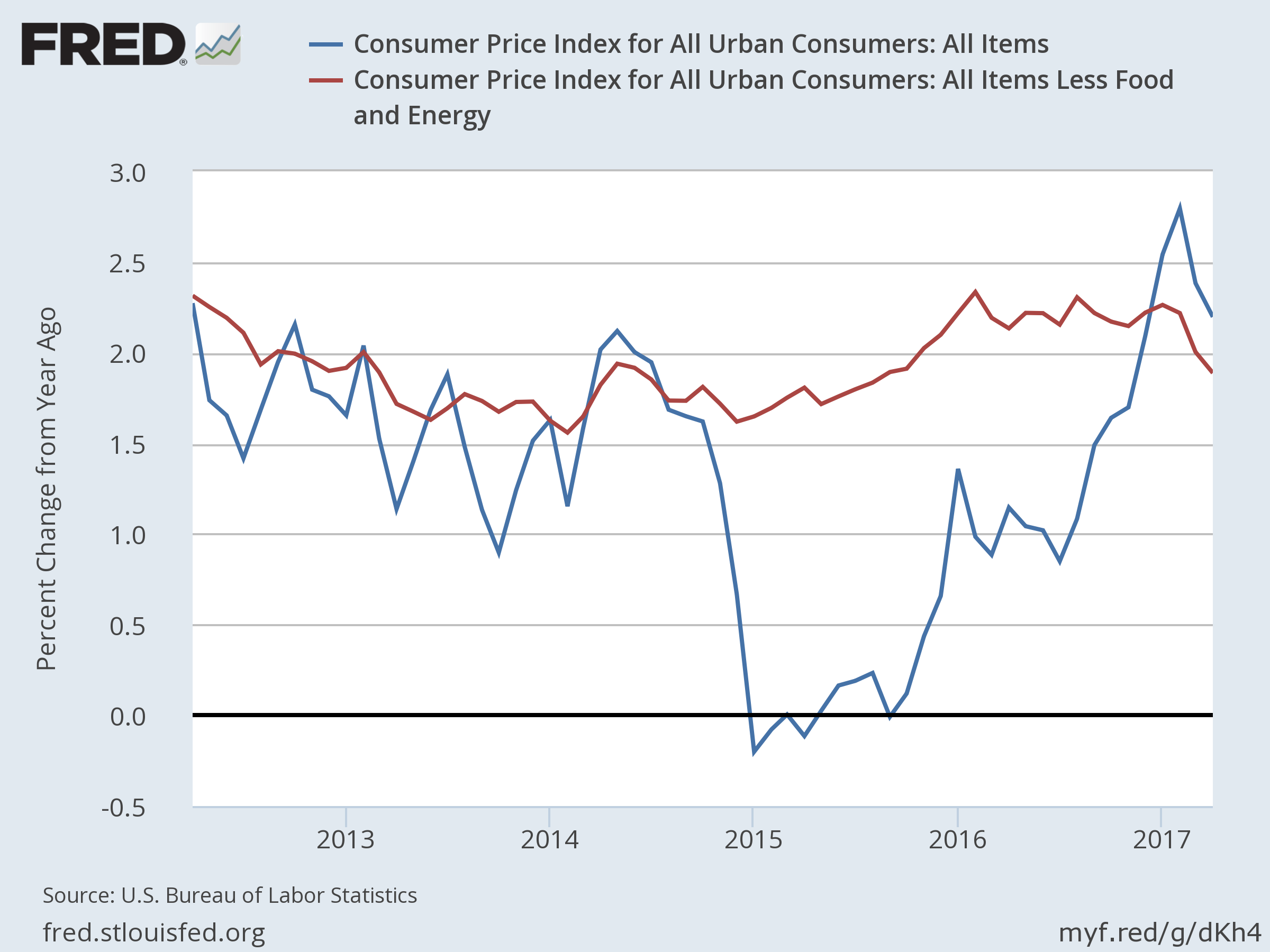

But last week’s softer-than-expected rise in consumer inflation in April gives the monetary doves a bit more ammunition and therefore raises fresh doubts about what to expect for monetary policy in June. The annual change in the Consumer Price Index ticked down for a second month, dipping to 2.2%. That’s still slightly above the Fed’s 2.0% target. Yet core CPI (less food and energy), a more reliable measure of inflation’s trend, fell to 1.9% — the first decline below 2.0% in more than a year.

Nonetheless, some analysts see the latest dip in consumer inflation as temporary and unlikely to deter the Fed from hiking next month. “Much of that weakness is likely to be transitory, in our view, particularly in the core services components,” Barclays economist Blerina Uruci advised in a research note. “In all, today’s data do not alter our view that the Federal Reserve will tighten policy in June.”

Meantime, the Treasury market’s implied inflation forecast (nominal yields less inflation-indexed yields) has been easing lately – a dovish development. The outlook via the 10-year spread, for instance, is just above 1.8% (as of May 15), down from 2.0%-plus in February.

The hawks, however, can still point to upbeat economic news of late. Employment growth perked up in April as did retail sales. In addition, Wall Street is expecting that GDP growth will post a strong rebound in the second quarter vs. the weak gain in Q1. The median estimate via CNBC’s Rapid Update survey for May 12, for instance, calls for a 3.4% increase in output in Q2, sharply above Q1’s tepid 0.7% advance.

Why, then, is the Treasury market’s inflation forecast still harboring doubts? It could be noise, of course. But the doves counter that the economy isn’t as strong as the latest numbers suggest. Treasuries seem to be on the fence.

This much is clear: if incoming data is sufficiently bullish, the market’s inflation forecast will likely firm up. When (if?) that happens, the case for expecting a rate hike in June will strengthen.

Philadelphia Fed President Patrick Harker effectively predicted as much on Friday. “Things are looking good, we’re essentially at normal now and … I continue to see two more rate hikes as appropriate this year.”

The question, then, is when will the Treasury market go all in on that outlook?

Pingback: Mixed Messages In Treasury Market For Rate Outlook - TradingGods.net