Industrial production in US was surprisingly weak in September, falling a hefty 1.3% vs. the previous month – far below Econoday.com’s consensus point forecast for a moderate 0.2% rise. That’s worrisome, but monthly data is noisy and so it’s premature to read too much into one monthly update.

A better way to contextualize post-recession economic trends is reviewing the results in relative terms vs. previous expansions. Let’s begin by comparing the industrial production index from the start of the current expansion, which is kicked off in May 2020, according to NBER. On that basis, output took off like a rocket in absolute and relative terms (red line in chart below).

The recent weakness trims the trend’s strength, but the current industrial expansion is still far ahead of rebounds in previous expansions since 1970. In other words, there’s still plenty of room for output to falter before it looks like a smoking gun for the economy.

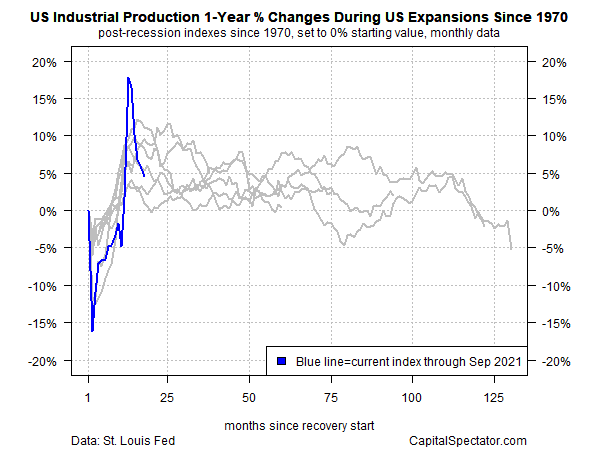

For another perspective, consider how rolling one-year percentage changes for industrial activity stack up vis-à-vis US economic expansions over the past half century. On this basis, the current state of the industrial sector’s rebound is middling. The current 4.6% one-year gain through September is still a respectable increase, but the sharp, ongoing deceleration is worrisome. All the more so since there’s far less room for deceleration in the months ahead until the one-year trend triggers a warning signal for the economic outlook.

For some forward guidance on the one-year trend, let’s project the near-term future with CapitalSpectator.com’s ensemble modeling, which uses eight models for a relatively robust estimate of ex ante data. On this basis, the deceleration appears to be ongoing for now.

Forecasts should be viewed cautiously, of course, particularly the further out in time the estimates run. As such, growth is likely to persist in the near term, but risk is on track to rise.

Industrial activity alone doesn’t determine the fate of recessions and expansions, although it’s certainly a key indicator. Keep in mind, too, that temporary factors reportedly played a roll in the industrial activity’s weakness last month.

Those factors will fade, although there’s still a high degree of uncertainty on timing. As a result, the industrial sector’s stumble of late is a mild risk factor for the economy. The question is whether the risk will persist and/or strengthen in final quarter of the year?

“While the hurricane disruption and weather effects will fade, labor and product shortages are still worsening, which will continue to weigh on manufacturing output over the coming months and quarters,” says Michael Pearce, a senior U.S. economist at Capital Economics.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Industrial Production Weak in September - TradingGods.net