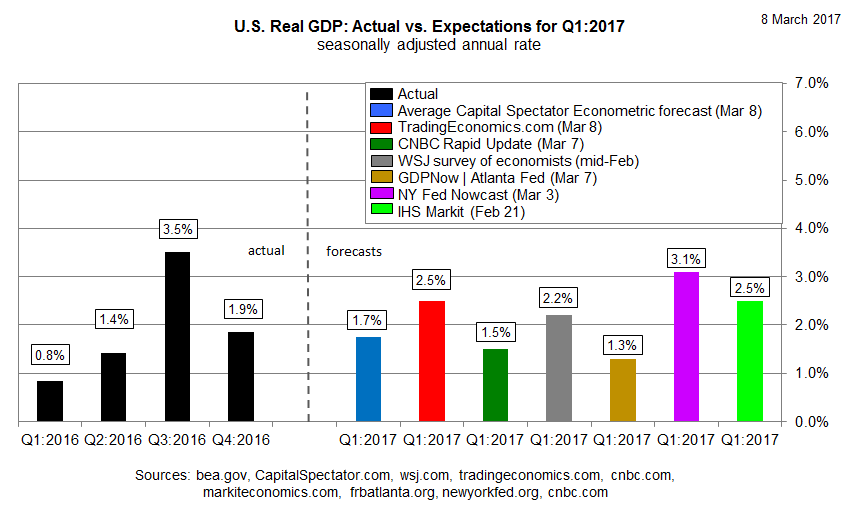

Yes, according to Tuesday’s revised GDP estimates from the Atlanta Fed and CNBC’s Rapid Update survey data. The Capital Spectator’s new economic projection is also anticipating a weaker pace of growth vs. last year’s fourth quarter. It’s too early to say for sure if the weaker forecasts are accurate (quite a lot of Q1 data is still a mystery at this point). But it’s fair to say that the prospects for a robust firming in the macro trend in the kick-off to 2017 is looking a bit wobbly compared with the previous review of GDP estimates from two weeks ago.

The Feb. 22 summary of GDP estimates offered a relatively upbeat assessment of growth prospects for this year’s first quarter. Several forecasts called for varying degrees of acceleration in economic activity following last year’s sluggish 1.9% increase in GDP. But the tide seems to be turning.

Yesterday’s revised estimate from the Atlanta Fed anticipates a weaker rise in output for Q1. The regional Fed bank’s GDPNow model is estimating Q1 growth at just 1.3%, well below Q4’s weak 1.9% increase. Among the factors weighing on the updated outlook: softer projections for personal consumption expenditures and real non-residential equipment investment growth, the Atlanta Fed explains.

Meanwhile, CNBC’s Rapid Update survey of economists remains at a 1.5% estimate for GDP growth in the first three months of this year, unchanged from the outlook two weeks ago.

The Capital Spectator’s average econometric forecast for Q1 is a bit higher at 1.7%. But that’s slightly below the 1.8% outlook published on Feb. 22, which suggests that the incoming data is trending in the wrong direction.

Other sources anticipate stronger growth, albeit based on older estimates. Notably, the New York Fed’s model sees output rising 3.1% in Q1 as of Mar. 3. But in the wake of softer estimates that have followed, it wouldn’t be surprising to see the New York Fed’s estimate slide in the next update.

Meanwhile, some investment banks are trimming expectations for Q1. Economists at Barclays, for instance, cut their forecast to 1.6% from 1.9%, largely due to a sharp rise in imports.

It’s still early for Q1 data, which raises the possibility that the next round of GDP estimates could perk up. The next major opportunity for an adjustment: this Friday’s employment report for February. Payrolls are expected to increase 195,000, according to Econoday.com’s consensus forecast. Although that’s down from the strong 227,000 rise in January, the projected February estimate is still a solid advance (assuming it’s accurate).

For now, however, there’s a bit more doubt about the macro trend in Q1. If there’s more than noise dragging the latest Q1 estimates down, we’ll see the evidence in the hard numbers in the days ahead.