Growth stocks have enjoyed an edge over their value counterparts in recent history, but market action of late suggests that the relative return drought for out-of-favor equities may be ending.

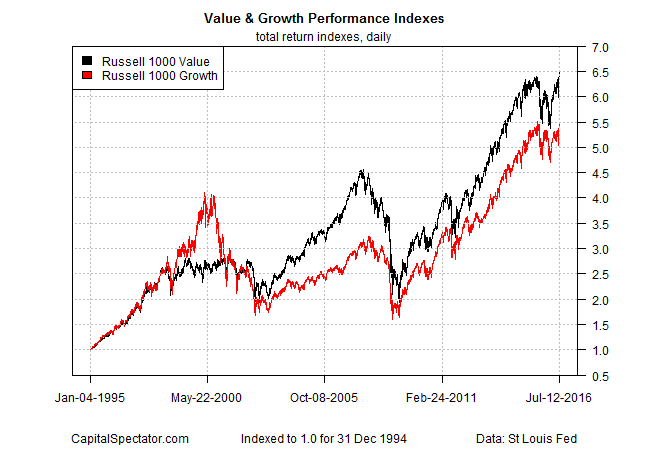

One clue is the recent revival in value outperformance over growth, based on a cumulative performance index that reflects the daily total returns for the Russell 1000 Growth and Value indexes. For the last two months, value has been beating growth for the first time since July 2015. Value’s edge has been slight, but the performance advantage has been consistent.

The return of the value bias hasn’t gone unnoticed in the investment community. Earlier this month, Robert Leggett at ValMark Advisers asked: “Is a Growth-to-Value Leadership Change Underway?” Writing at ETF Trends, he notes that “trees don’t grow to the sky and momentum stocks eventually falter. When that occurs, value will take command of the performance derby.” He adds that “the cycle of growth outperformance is stretched. Recent strong results from value should be monitored closely, as it could be an early sign of a new cycle in favor of value.”

The rearview mirror for several years, however, still paints growth in a favorable light, based on returns of ETF proxies. The iShares Russell 1000 Growth (IWF) is ahead by an annualized 12.2% for the trailing 3-year period through yesterday (July 12), according to Morningstar.com—a handsome lead over the 8.9% gain for the iShares Russell 1000 Growth (IWF). Growth is also moderately ahead of value for the trailing 5- and 10-year periods via this ETF pairing.

Nonetheless, betting against value for the long haul may be pushing your luck. When we look at trailing 15-year results, the leadership changes and iShares Russell 1000 Value has a slight edge over its growth counterpart: 6.4% vs. 5.7% in annualized terms.

The Russell indexes confirm the longer-run edge for value. A $1 investment in the Russell 1000 Value at the end 1994 would be worth roughly $6.5 as of yesterday—a tidy premium over the $5.5 for the same investment in the Russell 1000 Growth.

The value factor in US equities, in other words, appears to be intact. The price tag for tapping into this premium: periods of underperformance, sometimes lasting years.

The question is whether the value premium is again poised to deliver comparatively stronger results over growth? The case for answering “yes” looks a bit more compelling at the mid-point in the summer of 2016.

Pingback: Growth Stocks Have Been Popular Recently - TradingGods.net

Pingback: 07/13/16 – Wednesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weekend reading: May the force be with us – Frozen Pension

Pingback: Dash of Insight| Weighing the Week Ahead: What Might Derail the Stock Market Rally?

Pingback: Weighing The Week Ahead: What Might Derail The Stock Market Rally? | InvestingLab.com

Pingback: Weighing The Week Ahead: What Might Derail The Stock Market Rally? | OptionFN

Pingback: Weighing The Week Ahead: What Might Derail The Stock Market Rally? – Seeking Alpha – Daily Stock Advisor

Pingback: Weighing The Week Ahead: What Might Derail The Stock Market Rally? - FFN | First Financial News

Pingback: Earnings season Is in Full Swing - TradingGods.net