Dennis Gartman thinks we’re in one. UBS strategists also see elevated risk of a new bear market. Unfortunately, there’s econometric support for the negative outlook via a Hidden Markov model (HMM), which has proven to be a relatively reliable metric for monitoring regime shift in the market in real time.

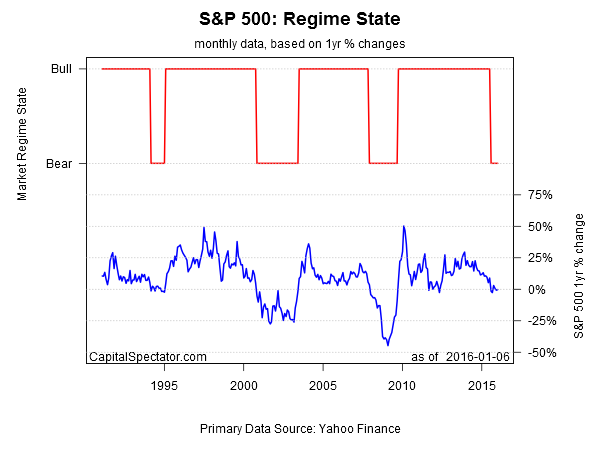

For details on The Capital Spectator’s use of HMM and its track record take a look here and here. As for the current data, the numbers paint a dark profile. Let’s start with the main smoking gun: the monthly numbers for the S&P 500 as seen through an HMM filter, based on analytics via the depmixS4 package deployed in R. As the first chart below shows, US equities have slipped into a bear-market regime for the first time since 2009—based on rolling 1-year returns via monthly data that’s updated this month through yesterday (Jan 6).

Looking at the data in terms of estimating the probability of a bear market via monthly data sends a similar message, namely: the trend has made a decisive turn for the worse.

Running the analysis with daily numbers reflects a bit more volatility in the signals–several HMM warnings have come and gone in recent months. The more stable but slightly less timely monthly analysis, on the other hand, has been firmly in bear-market territory since last fall in terms of the binary regime signal. The sight of the probability estimate jumping to nearly 100% for the monthly series strengthens the argument that the bear-market warning is now the genuine article.

As usual in matters of estimating the future there are plenty of caveats to consider. First, note that the analysis above is based on rolling one-year returns for the S&P, which is to say that using different trailing periods will dispense different results.

Even if we accept the idea that stocks are caught in a bear market, there’s the question of what that means for the weeks and months ahead? An HMM filter can be useful for putting the past into perspective, but the defining a bear market in terms of depth and duration is another subject entirely—and one with lots of ambiguity. As this recent primer from MarketWatch.com reminds, this is a warm and fuzzy topic.

In other words, there are no guarantees. That said, risk is certainly elevated relative to what we’ve seen in the last several years. The bottom line: there’s a notable increase in the growling noises these days.

Pingback: 01/07/16 – Thursday’s Interest-ing Reads | Compound Interest-ing!