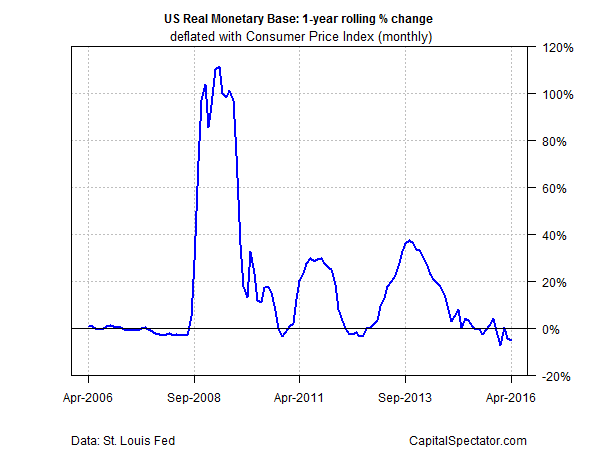

A second interest rate hike may be near, advised New York Fed President Bill Dudley on Thursday. “If I’m convinced that my own forecast is on track, then I think a tightening in the summer, the June-July time frame, is a reasonable expectation.” The release of Fed minutes from the last policy meeting fall in line with that thinking. So, too, does the April update on real (inflation-adjusted) base money supply (M0), which contracted in year-over-year terms in April, marking the third decline in the past four months.

The St. Louis Adjusted Monetary Base (deflated by the consumer price index) fell 5.4% last month vs. the year earlier level, a slightly bigger dip after the annual decline through March. The current year-over-year slide marks the third time that the Federal Reserve has embraced a tightening cycle since the last recession ended. In the previous two rounds of squeezing policy, based on M0 annual changes, the central bank relented and resumed a bias for stimulus. Is this time different?

Dudley’s latest comments certainly leave room for expecting that monetary policy will continue to tighten. As Reuters reports,

“June is definitely a live meeting depending on how the data evolves,” Dudley said, adding that he was “quite pleased” to see the market has priced in higher chances of a June rate hike this week.

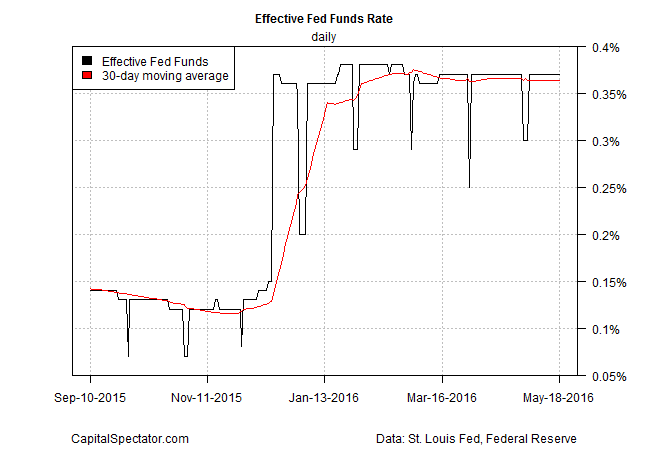

The effective Fed funds rate (EFF) is stable, holding at a level that’s prevailed for much of 2016 to date. But that doesn’t mean much. EFF offered no hint of a rate hike last December, ahead of the Fed’s announcement on the 16th of that month to increase its policy rate for the first time in nearly a decade to a 0.25%-to-0.50% range, which still stands. The EFF eventually surged to reflect the shift, but on Dec. 16th… after the fact (EFF data is released with a lag).

Market sentiment, however, has abruptly changed in line with Dudley’s comments. Fed funds futures (based on CME data for May 19) are now pricing in a 70% probability of a rate hike at next month’s FOMC meeting—a dramatic shift from the recent past, when a June squeeze was widely dismissed as unlikely.

Earlier this week Tim Duy, an economics professor at the University of Oregon who pens a widely read blog on Fed policy, was skeptical that the central bank would raise rates again in June. He recognized that the latest minutes leaned toward a hike, but “ultimately, I think they pass on June.”

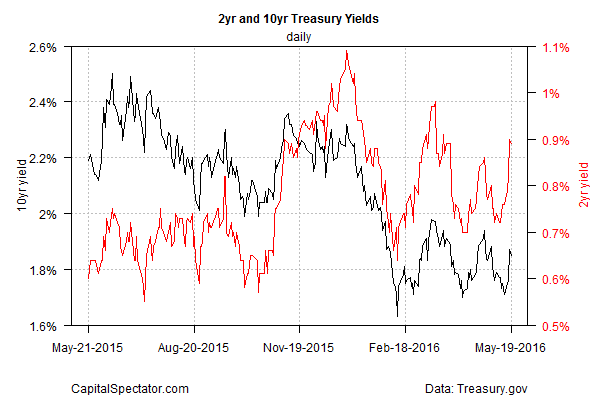

Dudley prefers that the crowd thinks otherwise. Mission accomplished, at least for the moment. The 2-year Treasury yield—considered the most sensitive spot on the curve for rate expectations—has popped and is currently at 0.89% on Thursday (May 19), based on daily data via Treasury.gov. That’s close to the highest level since late-March.

Perhaps, then, it’s all about the incoming numbers for the next several weeks for deciding if the Fed’s set on a course for a rate hike announcement on June 15. The main event is the May report on US payrolls, scheduled for release on June 3. One or two data points may not mean much in the grand scheme of monetary policy… in theory. But embracing such wisdom may be a tough sell in the weeks leading up to the next FOMC meeting in the wake of Dudley’s hawkish comments.

Pingback: Is The Case For A June Rate Hike Premature? – Investor Maven