Clarity is a virtue when it comes to the business cycle. It’s also unusual. The US is an exception, or at least it has been, according to Scott Sumner, an economist at Bentley University and a prolific blogger on macro matters. “The US has a really weird economy,” he writes. “All our recessions are 100% clear-cut. Either we have a recession or we don’t. Normal countries have borderline recessions. Not us.” But this uncommon trait “is about to end, and very soon we’ll have debatable recessions,” Sumner advises. If he’s right, macro analysis—looking for signs of major shifts in the economic trend in particular—will be a lot tougher.

For some perspective, Sumner points us to Japan, which reportedly slipped into a new recession in this year’s third quarter. But is that label appropriate for country with a jobless rate at a low 3.6% (vs. 5.8% in the US and 11.5% in the Eurozone)? Indeed, neither the US nor Europe is in recession, partly due to positive GDP comparisons (albeit just barely for the countries that share the euro).

The US business cycle has, to date, been a paragon of clarity. The tell-tale signs that separate growth from contraction have been relatively clear. Unemployment rises sharply, spending and output decline, and it soon becomes obvious where the expansion ended and the slump began. One of the advantages of clear-cut breaks in the trend: higher odds of success for developing an econometric model that generates early warning signals of macro danger (see my Economic Profile updates, for instance). No one will confuse the art/science of analyzing the business cycle as easy, but Sumner thinks this corner of macroeconomics is destined to suffer a higher level of nuance.

He admits that he could be mistaken, perhaps because of a major shift in, say, immigration policy or some type of economic reform that materially alters the macro landscape for the better. Meantime, several factors are unfolding that are pushing the US into an era of relatively subtle business cycles. “The prime age workforce will soon stop growing, and productivity growth is slowing as well,” he notes. “Get ready for lots of phony ‘recession’ stories, especially when the party in power is not well liked by the intelligentsia.”

Driving Sumner’s outlook is an expectation that the trend rate for real GDP growth for the US is destined to fall to a sluggish 1% from 3% of late.

After we “recover” it will no longer be unusual to see two straight quarters of falling RGDP. But will they be true recessions? Or the sort of phony “recession” that people think they are seeing in Japan, and that was reported in the UK a couple years ago, which later vanished with revisions in the data? (I’m referring to Britain’s triple dip; even the double dip was very debatable, with only a 1/2% rise in unemployment.)

Sumner’s hardly alone in expecting US growth to slow in the years ahead. Robert Gordon, an economics professor at Northwestern University and a member of the Business Cycle Dating Committee at the National Bureau of Research, anticipates “much slower” growth for the US in the years ahead. Tyler Cowen of George Mason University, in his 2011 book The Great Stagnation, also projects a lesser pace of growth for the long run:

The American economy has enjoyed lots of low-hanging fruit since at least the 17th century, whether it be free land, lots of immigrant labor or powerful new technologies. Yet during the last 40 years, that low-hanging fruit started disappearing, and we started pretending it was still there. We have failed to recognize that we are at a technological plateau and the trees are more bare than we would like to think.

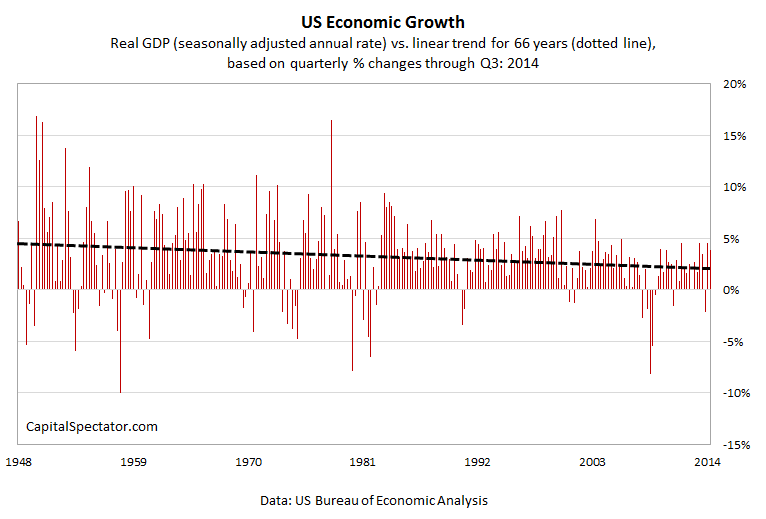

Such gloomy outlooks are, in fact, expectations that the historical deceleration already in progress will roll on. Looking at the past US GDP trend in the post-World War II era reflects a conspicuous decline in growth to roughly 2.5% real since the Great Recession ended in mid-2009 vs. close to 4% during the golden age of American economic dominance from 1948 through 1970 (based on annual rates of GDP changes).

No one really knows what the future will bring, of course, particularly across long stretches of time. But for the moment, there’s a reasonable case for managing expectations down for growth, if only in relative terms. Some of this is due to the natural evolution of progress. As the world’s largest economy, America faces limits on maintaining former rates of growth. But this challenge is compounded at the moment by the ongoing blowback from the extraordinarily hefty price tag of the 2008-2009 recession, which left the global economy hobbled with debt, a higher capacity for disinflation/deflation, and lesser prospects for growth.

The burden is arguably a bit lighter and the outlook for something better has improved of late. But the headwinds are still with us, and probably will be for some time. As a result, the potential for a lesser trend rate for US growth is plausible if not necessarily inevitable. In turn, Sumner’s prediction that it’s going to be harder to identify the start of US recessions is credible. Analyzing the biggest known risk factor in the money game was never anyone’s idea of a picnic. If Sumner’s right about what’s coming, monitoring recession risk is destined to get a lot tougher as analysts and their business cycle models struggle to overcome the curse of subtlety.