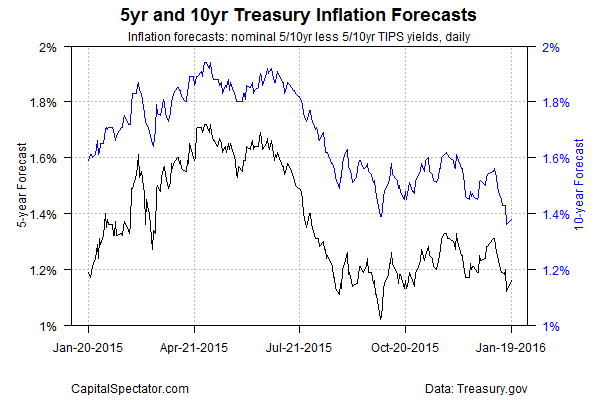

Inflation expectations in the US are sliding again, raising new concerns about the economic outlook. Perhaps today’s update on consumer prices for December (due out at 8:30 am eastern) will allay fears that disinflation risk has reaccelerated. Meantime, Mr. Market has been lowering his outlook for pricing pressure… again.

The yield spread on nominal less inflation-indexed 10-year Treasuries dipped to 1.36% last Friday (Jan. 15)—a six-year low, based on daily data from Treasury.gov. The market’s implied inflation forecast rebounded a bit yesterday, ticking up to 1.38%. But it’s clear that expectations for the future path of inflation are again moving in a worrisome direction.

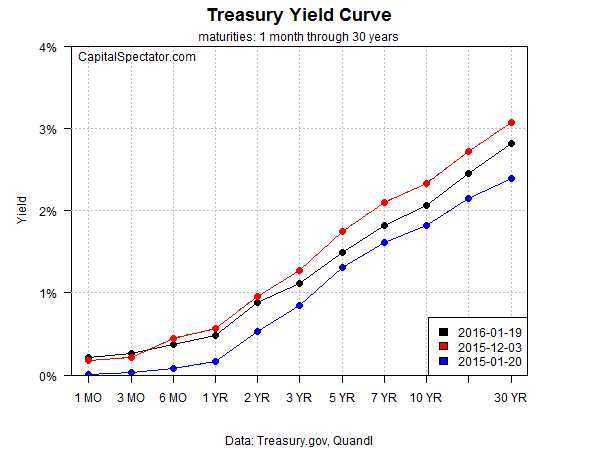

Meanwhile, the yield curve has shifted down across the maturity spectrum. Other than the short end of the curve, where the Fed’s influence is greatest, there’s been a decline in yields over the past 30 trading days through Jan. 19–from the 6-month maturity up to the 30-years (black line in chart below).

Recent comments from two Fed officials have helped fan the flames for worrying about a new phase of disinflation risk. “Headline inflation will return to target once oil prices stabilize, but recent further declines in global oil prices are calling into question when such a stabilization may occur,” noted St. Louis Fed President James Bullard last week. Meanwhile, Chicago Fed President Charles Evans on Jan. 13 observed that by some accounts

the equilibrium inflation-adjusted rate is currently near zero. This rate should rise gradually as the headwinds fade over time. But until they do, monetary policy rates must be even lower than they otherwise would be to provide adequate accommodation for economic growth.

Fed Chair Janet Yellen last month said that “convincing evidence that longer-term inflation expectations have moved lower would be a concern because declines in consumer and business expectations about inflation could put downward pressure on actual inflation, making the attainment of our 2 percent inflation goal more difficult.”

That debate is still open, but for the moment the numbers are looking a bit shaky. It doesn’t help to see that fourth-quarter GDP growth for the US is on track for a weak 0.6% rise, based on the current nowcast from the Atlanta Fed’s GDPNow model. If the projection, holds, growth will decelerate sharply vs. Q3’s 2.0% increase.

Does this mean that another Fed rate hike is on hold? Probably, although much depends on how Exhibit A for the monetary hawks—payrolls—fares in the January update that’s due in early February.

Meantime, the safe-haven trade is alive and kicking once more. Bloomberg advises that equities on a global basis are on the edge of a bear market via the MSCI All-Country World Stock Index.

“I am quite pessimistic about the equity markets for the next two to three months,” Andreas Clenow, hedge fund trader and principal at ACIES Asset Management, tells Reuters. “I do not see a 2008-style scenario, but I do see a bear market coming”–a risk that’s been discussed on these pages recently, including this post from Jan. 7.

To the extent that bearish sentiment has legs, the crowd will continue to pile into Treasuries and push yields (and implied inflation expectations) lower still. The antidote, of course, is robust economic data. But for the moment, that’s in short supply via last week’s disappointing news on retail sales and industrial activity. Will today’s housing starts offer a more encouraging profile?