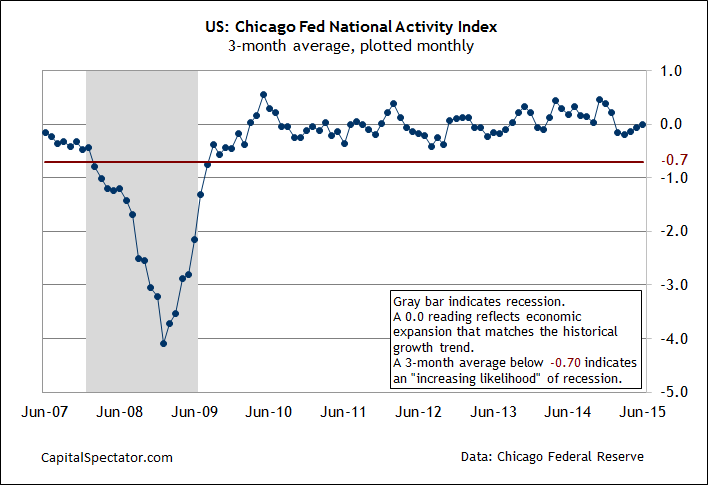

The Chicago Fed National Activity Index’s three-month average (CFNAI-MA3) increased to -0.01 in June, reflecting US economic growth that’s effectively at the historical trend rate (i.e., a reading of zero). The rise marks the third consecutive month of modest improvement in economic output, according to this metric in today’s report from the Chicago Fed. The revised data for last month “suggests that growth in national economic activity was very close to its historical trend,” the bank noted in a press release.

Today’s numbers support the view that the US economy is strengthening after a mild bout of contraction in this year’s first quarter. Recession risk is certainly a low-probability threat based on today’s update. Indeed, the current June CFNAI-MA3 reading of -0.01 is well above the -0.70 mark that signals the start of new recessions, according to Chicago Fed guidelines.

Analzying the updated CFNAI-MA3 data with a probit model continues to show that the probability is low (roughly 4%) that a recession started in June. The current risk estimate in the chart below is based on a probit regression that analyzes the historical record of NBER’s business cycle dates in context with CFNAI-MA3. The low risk estimate aligns with Monday’s update on business cycle risk via The Capital Spectator’s proprietary indexes.

Pingback: Chicago Fed National Activity Index Increased

Pingback: Wall Street National | Early US Macro Clues For July Look Encouraging - Wall Street National