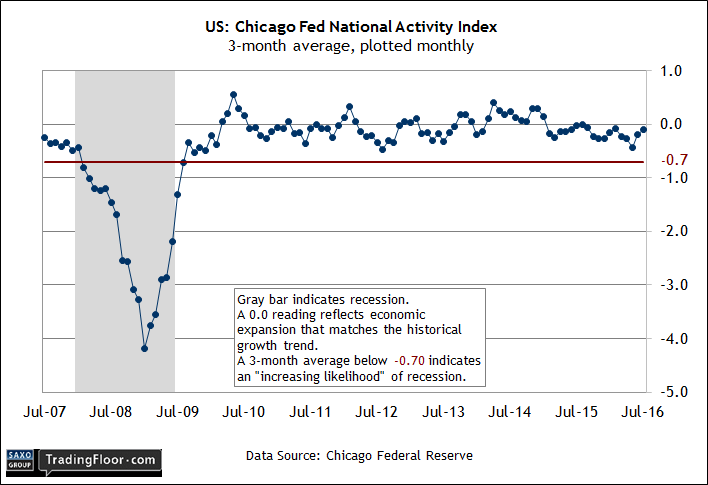

US economic growth strengthened for the second month in a row in July, according to this morning’s update of the three-month average of the Chicago Fed National Activity Index (CFNAI-MA3). Last month’s reading ticked up to -0.10, the highest level since February. Today’s update effectively confirms that the recession risk remained low last month.

Only values below -0.70 for CFNAI-MA3 signal the start of recession, according to Chicago Fed guidelines for this benchmark. As such, the probability is low that an NBER-defined contraction is near, based on published data to date.

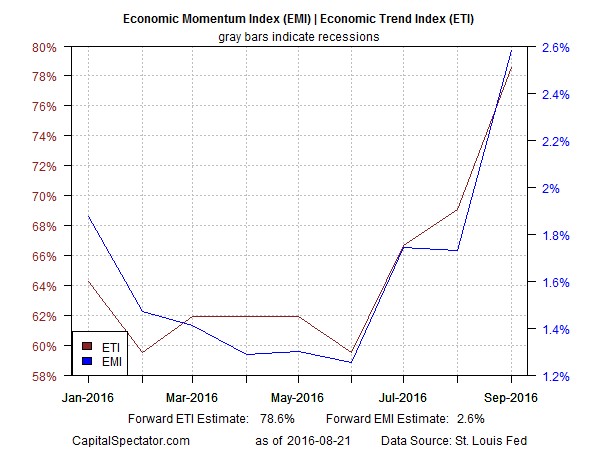

The improvement in US economic activity falls in line with the econometric outlook in the US Business Cycle Risk Report, which has been projecting a firmer trend for months. For example, here’s how yesterday’s update of the near-term estimate for the Economic Trend and Momentum indices compare through September 2016. (Keep in mind that the last full month with a complete set of economic data at the moment is May 2016.) In contrast with the relatively weak reading through June, the third-quarter trend is on track to post a moderate improvement.

To put the data into historical context, here’s a long-term chart of ETI and EMI:

Pingback: 08/22/16 – Monday’s Interest-ing Reads | Compound Interest-ing!