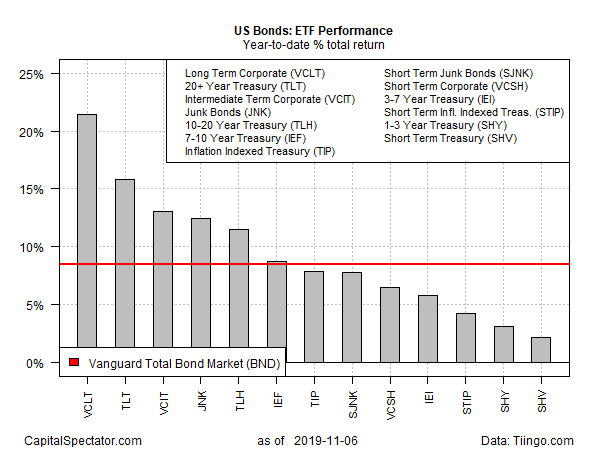

Fixed-income investing has been a winner in no small degree this year. Throwing money at almost any slice of US bonds has been a winning decision, based on a set of exchange-traded funds. Notably, favoring bigger duration risks has delivered bigger returns.

For the top-performing slice of US fixed income, this year’s results so far have, at times, rivaled the extraordinary run in US stocks. Indeed, the current year-to-date leader on our bond ETF list could be mistaken for an equity fund if you looked only the price histories. Vanguard Long-Term Corporate Bond (VCLT) is up a red-hot 21.4% so far this year (through Nov. 6). That’s behind the US stock market (SPY), although a few weeks back VCLT was in the lead.

VCLT’s rally, however, is looking a bit tired these days. After a virtually non-stop run through early September, the fund has been mostly treading water over the past two months.

The possibility of a partial resolution to the US-China trade war is a factor weighing on the bond market this week. “Trade progress via the US and China being said to consider partial tariff rollbacks, coupled with most recent top-tier data prints coming in stronger than consensus, paints a textbook picture for higher rates and equities as near-term recessionary fears moderate,” writes Jon Hill, an interest-rate strategist at BMO Capital Markets, in a research note to clients.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The rear-view mirror, however, still looks impressive for US bonds generally. Indeed, even the investment-grade benchmark for fixed income — Vanguard Total Bond Market (BND) – is posting a solid 8.4% total return so far in 2019.

Some analysts are advising that changes in central bank policy may create new headwinds for bonds from this point forward.

“We are past the peak of central banks easing,” warns Peter Schaffrik, a global macro strategist at RBC Capital Markets. “You may get a few more cuts here and there, but the extreme cutting phase is over. And with that, yields in the US and globally are at risk of going higher. I’d be cautious about fixed income now.”

Nonetheless, the bond bulls can point to recent data that shows economic growth is still slowing, which implies that more monetary easing is in the cards. If so, bond prices can still rise further.

In the US, for instance, the Atlanta Fed’s GDPNow model this week trimmed the outlook for fourth-quarter output to a weak 1.0% increase, down from 1.9% in Q3.

For the moment, however, Fed funds futures are pricing in a high probability that the Fed will leave interest rates unchanged at the next FOMC meeting on Dec. 11.

The global trend, however, still appears to be sliding. The JP Morgan Global Composite Output Index, a proxy for global GDP, slipped to its lowest reading in October in nearly four years — indicating a near-stagnant pace of growth.

If there’s trouble brewing for US bonds, it’s not yet obvious in the pricing trend via a set of moving averages. The first metric compares each ETF’s 10-day moving average with the 100-day average — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). The indexes range from 0 (all funds trending down) to 1.0 (all funds trending up). For the moment, the crowd is pricing sunny skies ahead for US fixed income. Indeed, both metrics are currently reflect perfect bullish scores.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Investing in US Bonds Has Been a Winning Decision This Year - TradingGods.net

Pingback: This Week’s Best Investing Articles, Research, Podcasts 11/8/2019 - Stock Screener - The Acquirer's Multiple®