Ahead of revisions to the US equity sector landscape in a few days, the existing definitions show that consumer discretionary, technology, and health care shares continue to lead this year, based on a set of exchange-traded funds. The upcoming reshuffling may reorder the horse race, but for now these three sectors are the dominant year-to-date performers through yesterday’s close (Sep. 18). Meanwhile, shares that comprise the so-called consumer staples sector are in the red year to date, posting the second-worst performance for the major sectors.

Consumer Discretionary Select Sector SPDR (XLY) has recently pulled into lead this year, posting a strong 19.2% total return. Nipping at its heels is Technology Select Sector SPDR (XLK), which is up 17.2% year to date. In third place: Health Care Select Sector SPDR (XLV) via a 14.2% gain.

Strength in consumer stocks that are considered the most sensitive to the economic cycle – i.e., the discretionary slice of the consumer sector — is no surprise when you consider that sentiment on Main Street is roaring. The preliminary estimate of this month’s University of Michigan’s Index of Consumer Sentiment posted a solid rise, marking the second-highest reading this year and also the second highest since 2004. Meantime, “the Expectations Index reached its highest level since July 2004, largely due to more favorable prospects for jobs and incomes,” Richard Curtin, chief economist for the Surveys of Consumers, said on Friday.

A New Book On Using R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The hard data on consumer spending supports the upbeat mood, based on the broad trend in the latest numbers. Headline retail sales increased for a seventh straight month in August and grew 6.6% on a year-over-year basis – close to the fastest annual gain in eight years.

Note, however, that companies that fall under the heading of consumer staples are lagging in 2018. “Staples are not necessarily the bastions of steady growth, strong cash flow and high dividend payouts they once were,” according to BlackRock’s Kate Moore.

The crowd seems to agree, at least for now. Consumer Staples Select Sector SPDR (XLP) has the second-worst sector performance year to date, posting a 2.5% loss so far in 2018.

The tailwind for US equities generally, on the other hand, is quite strong. The SPDR S&P 500 (SPY) so far this year is ahead by 9.9% year to date – higher than all but three sector performances.

As for relative returns this year, the chart below shows the runaway leadership that’s prevailed in consumer discretionary (XLY), tech (XLK), and health care (XLV) recently.

The dominance of the top-three sector performers also shows up when ranking the ETFs by current price relative to 200-day moving average. On this momentum score, the health care fund (XLV) is in the lead by a hair.

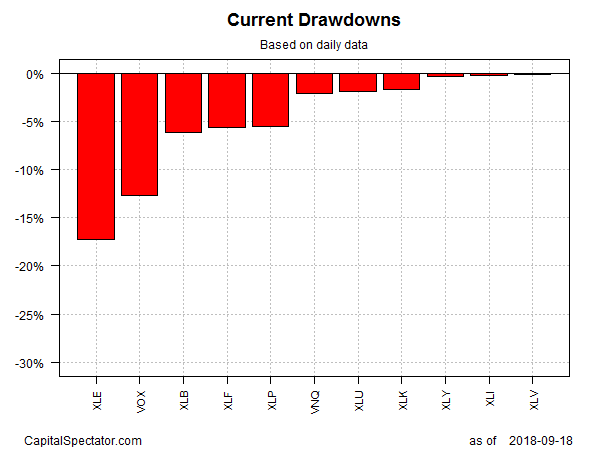

Profiling the sector ETFs based on current drawdown reveals that health care (XLV) is also posting the smallest (virtually nil) drawdown at the moment. Meanwhile, Energy Select Sector SPDR (XLE) has the biggest current drawdown — more than 15% below its previous peak.

Keep in mind that the sector landscape will change substantially after next week’s revisions. For an overview, see this summary at State Street Global Advisors (SSGA). From a top-down perspective, the biggest changes in terms of S&P 500 weights are slated for technology, communications services, and consumer discretionary (see table below).

“The sector landscape is about to witness its biggest shakeup since 1999 when the Global Industry Classification Standard (GICS) was developed,” SSGA reports. “On September 21, securities with a market value of roughly $2.8 trillion will be reclassified within the GICS. The changes will happen across three sectors and 26 stocks, representing 10% of the market cap of the S&P 500® Index.”

For now, discretionary consumer shares are red hot and comfortably in the lead. The question is how the horse race will change after the sector reshuffling?

Pingback: A Tale Of Two Consumer Sector Returns: Discretionary vs. Staples - TradingGods.net