Reuters reports that emerging markets are in “melt up” mode as “cash returns to global markets.” The news outlet quotes Bank of America Merrill Lynch’s global strategy team, which advises in a note to clients that “sentiment (is) getting more bullish but not yet at an extreme.” Let’s take a closer look by way of proxy funds.

The Vanguard FTSE Emerging Markets ETF (VWO) is certainly posting firmer results these days. The fund’s 50-day moving average has been above the 200-day average since May and in recent days the fund’s price-only performance (unhedged US dollar terms) has again rebounded into positive territory for the trailing one-year performance.

A similar profile applies to emerging-market bonds (unhedged US dollar terms) via the Van Eck Vectors JP Morgan EM Local Currency Bond ETF (EMLC).

Upside momentum, in other words, has returned to stocks and bonds in emerging markets in a relatively convincing degree.

The revival isn’t terribly surprising for Research Affiliates, which has been posting comparatively high expected returns for emerging market stocks and bonds for some time. Stocks in these countries, for example, are on track to deliver nearly 8% real annualized returns over the next decade, the firm projects—well above the rest of the field for broadly defined asset classes.

For comparison, see this month’s update of The Capital Spectator’s risk premia estimates for the major asset classes. Here too the forecast is relatively rosy: emerging market equities are expected to earn a 6.9% risk premium (total return before adding in an expected “risk-free” rate) over the long haul—second only to the outlook for foreign REITs/real estate securities.

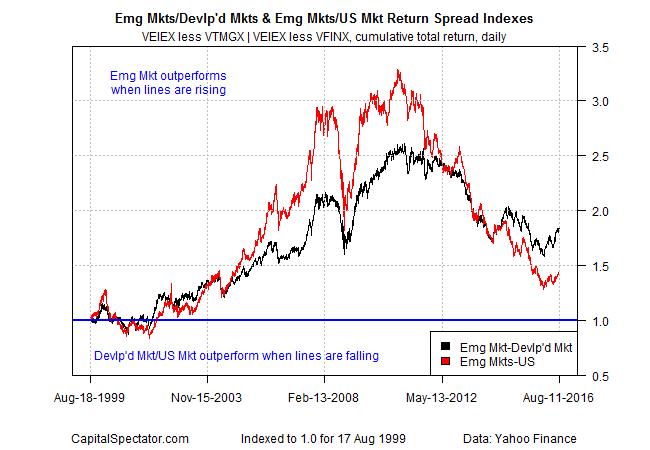

Finally, let’s put the latest bounce in emerging-market stocks into historical perspective vis-à-vis stocks in the developed world ex-US and the US equities. The proxies are three equity mutual funds, which claim a moderately longer history vs. their ETF counterparts:

Vanguard Emerging Markets (VEIEX)

Vanguard Developed Markets (VTMGX)

Vanguard S&P 500 (VFINX)

With a start date of Aug. 17, 1999 through yesterday (Aug. 11, 2016), the next chart tracks the cumulative daily return spread for emerging less developed markets and emerging less the US. When the lines are rising (falling), the emerging market fund is outperforming (underperforming) in relative terms.

Using the chart above as a benchmark, the current bounce still looks quite mild relative to history. The previous boom in emerging markets in relative terms peaked in 2011. The subsequent downfall has been long and steep. But there are hints that the bear market for emerging markets may be over.

The rebound in emerging markets is still in the early stages, which is a double-edged sword. On the one hand it’s too soon to tell if the revival is another false dawn—there have been several in recent years. Then again, if this is the genuine article, the fact that it’s still early implies that there’s still a deep well of opportunity for jumping on board the gravy train.

All the usual caveats apply when looking into the future, of course. That said, this is a good time for investors with a relatively low or zero allocation to emerging markets to reassess and review the outlook for a long-suffering slice of the global market that’s suffering a bit less at the moment.

Pingback: 08/12/16 – Friday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Bob Carlson » Reviewing the Emerging Markets