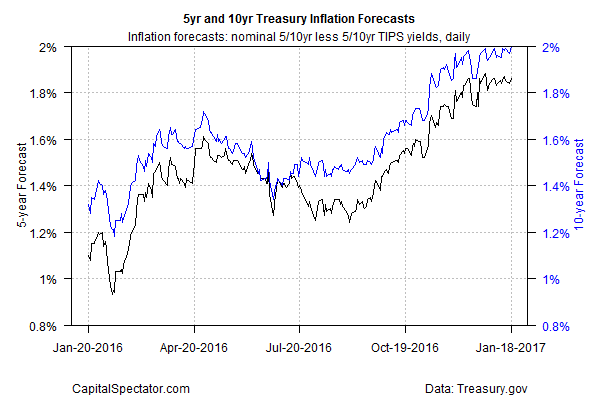

The Treasury market’s implied inflation forecast via 10-year yields touched 2.0% on Wednesday (Jan. 18) for the first time in more than two years as Federal Reserve Chair Janet Yellen gave an upbeat assessment of the US economic outlook. “The economy is near maximum employment and inflation is moving toward our goal,” she said in speech.

Although minds continue to differ as to whether the economy is on a sustainable path to higher growth, the Treasury market continues to price in a future of higher inflation. For the first time since Sep. 2014, the implied forecast via the yield spread on the nominal less inflation-indexed 10-year Notes reached 2.0%, based on daily data via Treasury.gov.

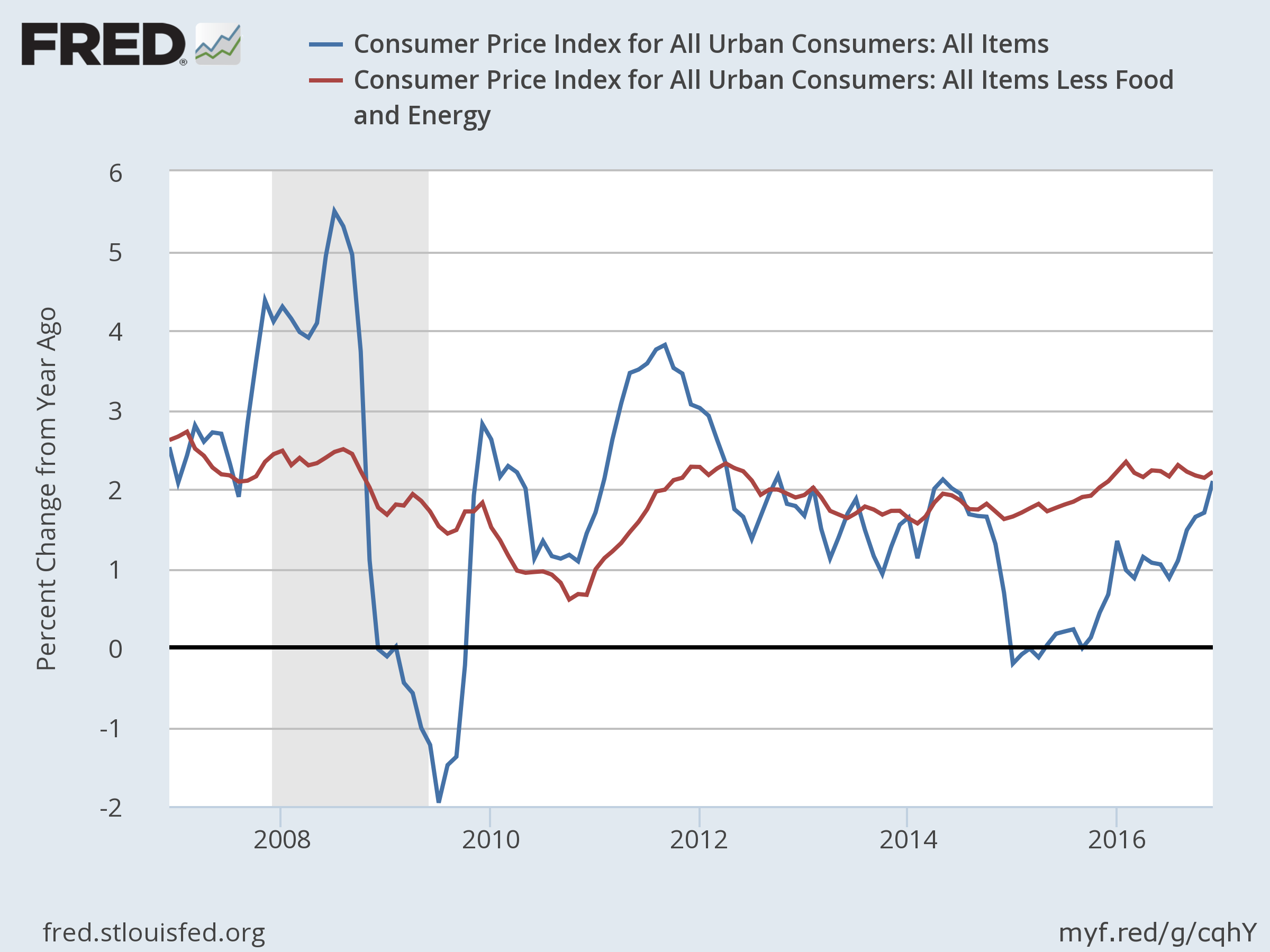

Meantime, the hard data on inflation is climbing. Yesterday’s December report on consumer prices shows that headline inflation is running at a 2.1% annual pace—the highest rate in nearly two years. Core CPI, which is considered a more reliable measure of pricing trends, is even higher, running at 2.2% for the year through last month. Although the annual change in core CPI has been slightly higher recently—2.3% in Feb. 2016—the current rate is close to that post-recession peak.

“Further momentum in consumer prices could add to the perception of a more hawkish Fed and the potential for more aggressive tightening,” observes Jim Baird, chief investment officer at Plante Moran Financial Advisors.

In fact, the Cleveland Fed’s latest projections for inflation suggest that upside momentum is a reasonable forecast. The bank’s Jan. 18 estimate for headline CPI’s annual rate in this year’s first quarter is nearly 2.5%, or moderately higher than the 2.1% increase in December.

Inflation is rising in Europe too. German pricing pressure accelerated last month, reaching the fastest pace since 2013. Consumer prices for Europe overall are on the rise too. The European Union’s statistics agency yesterday reported that the annual inflation rate in December nearly doubled to 1.1% from 0.6% in the previous month, largely due to a rebound in energy prices.

Nonetheless, the firmer readings on inflation in the US and Europe appear to be a sign that the deflation/disinflation regime has ended. That doesn’t mean that runaway inflation is imminent, although recent data implies that a firmer pricing trend has arrived.

The question is whether economic growth will accelerate too? That’s the forecast in some circles, based on rosy assumptions about the policy agenda for the incoming Trump administration. Earlier this month, for instance, Deutsche Bank predicted that Trump’s plans for cutting taxes, paring regulations, and ramping up infrastructure spending could double US GDP growth by 2018.

Maybe, but for the moment the crowd’s expecting that the fourth-quarter GDP report that’s due later this month will post a moderately softer rate of growth vs. Q3’s solid 3.5% increase. The Atlanta Fed’s GDPNow model’s (as of Jan. 13) estimates last year’s final quarter will post a 2.8% rise. The New York Fed’s model points to an even slower gain: just 1.9% for Q4, based on the Jan. 13 update.

The case for a higher level of optimism, it seems, rests with expectations on what a President Trump can do for the macro trend. It may be tempting to think positively, but there’s also a case for caution, giving the President-elects wide-ranging agenda. For instance, one of Trump’s advisors says that the US could win a trade war with China.

Is such thinking the basis for anticipating stronger economic growth? Let’s just say that there’s still plenty of room for debate.

Pingback: The Treasury Market's Implied Inflation Forecast Via 10-Year Yields Hit 2.0% - TradingGods.net